A marketing analytics firm called Alteryx left the personal data from 123 million American households unsecured on the internet as first reported by Forbes recently. This blog post will provide some of the basic info surrounding the breach and share four recommendations on how to stay safe.

First, more on the breach.

- The data set included 248 unique data fields covering a variety of very specific personal information, including:

- address

- age

- gender

- education

- occupation

- marital status

- mortgage and financial info

- phone numbers

- number of children in household

- Anyone with an easily obtainable account could have had access.

- No names were included, though experts say it wouldn’t be hard for someone to connect the info when they have the address and phone number.

- California-based marketing analytics company Alteryx owns the data, which includes data sets from consumer credit reporting agency Experian, an Alteryx partner, as well as from the U.S. Census Bureau.

“The exposed data reveals billions of personally identifying details and data points about virtually every American household,” writes the security researchers at UpGuard who discovered the unsecured data repository. They contend it puts consumers at risk “for a range of nefarious activities, from spamming to identity theft,” according to this cnet.com story.

Between breaches such as this and the Equifax breach revealed in September in which the personal identifying information (including names, Social Security numbers and addresses), experts say you should just assume your identity has been stolen.

So what can you do, if anything? There are some specific steps we recommend you take.

4 Things You Can Do To Stay Safe

1. Monitor Your Credit

This is easy to do for free and it’s silly to pay a company to do this. (Instead, consider paying for a membership to a restoration company — someone who will fix the damage if your identity is stolen.) Just remember, the threat is ongoing. It’s not going to do you any good to watch this closely for a few months and then get complacent and stop.

2. Watch Your Financial and Medical Statements Closely

You should keep a close eye on your bank and investment statements. Consider looking at them weekly rather than monthly. Also, watch the Explanation of Benefits statements from your health insurance company. Basically, you need to be hyper-vigilant.

3. Freeze Your Credit

Yes, you could and probably should freeze your credit (we explain how to do it here). And be sure you freeze your credit instead of locking it. For the lowdown on the difference between the two, check this post out. After the Equifax breach, the credit bureaus started pushing people to lock their credit rather than freeze it, but a freeze is definitely the better route.

But it’s important to note that while a credit freeze might be a good line of defense, there are also limitations. While it does help prevent some new accounts requiring a credit check from being opened (not all new accounts require a credit check), it doesn’t safeguard the accounts you already have open. Plus, it won’t prevent all types of identity theft.

That’s worth repeating: There are many serious forms of identity theft that won’t show up on your credit report, including criminal identity theft, Social Security identity theft, employment identity theft, tax identity theft, and medical identity theft. Again, a credit freeze is only one defense against identity theft.

4. Sign Up For a Restoration Membership — The Most Crucial

Identity theft happens all the time, but what if it happened to you? The average identity theft victim spends 200+ hours trying to repair the damage. If you have an identity restoration membership, that time is significantly reduced because they perform the work for you. LibertyID is an identity restoration company and there’s no limit to the time or money we will spend restoring your identity to pre-event status. If you’re a LibertyID member and your identity is stolen, we will fix it.

A certified restoration specialist will handle all of the legwork (like submitting disputes to lending institutions, utility companies, cell phone carriers, etc. and researching and documenting erroneous info on your credit file and having it removed). They will keep you informed with regular status updates.

The bottom line is there’s really no better time than the present to become a LibertyID member. LibertyID provides expert, full service, fully managed identity theft restoration to individuals, couples, extended families* and businesses. LibertyID has a 100% success rate in resolving all forms of identity fraud on behalf of our subscribers.

*Extended families – primary individual, their spouse/partner, both sets of parents (including those that have been deceased for up to a year), and all children under the age of 25

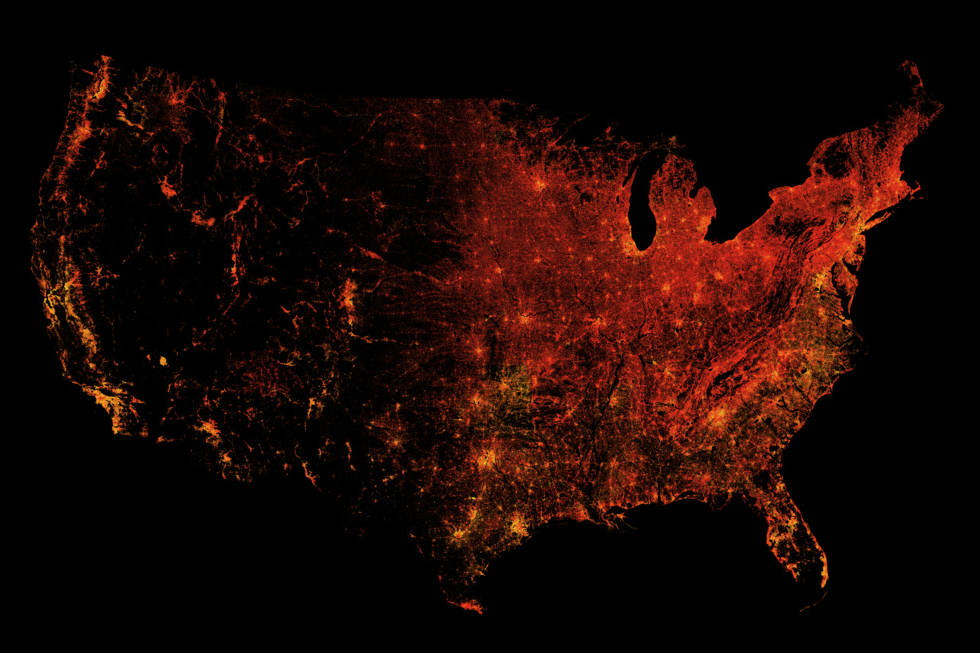

Photo Credit: Diversity index of the contiguous United States by block, Eric Fischer, Creative Commons Attribution-ShareAlike 2.0