On September 8, 2014, Home Depot announced their payment systems had been breached, exposing the information of up to 56 million customers in the U.S. and Canada. A similar breach occurred at Target Corporation in 2013, affecting an estimated 70 million customers. And in 2011, a security breach at Sony compromised 130 million accounts.

The Bad News: Data Breaches Increase The Likelihood Of Identity Theft For Affected Customers

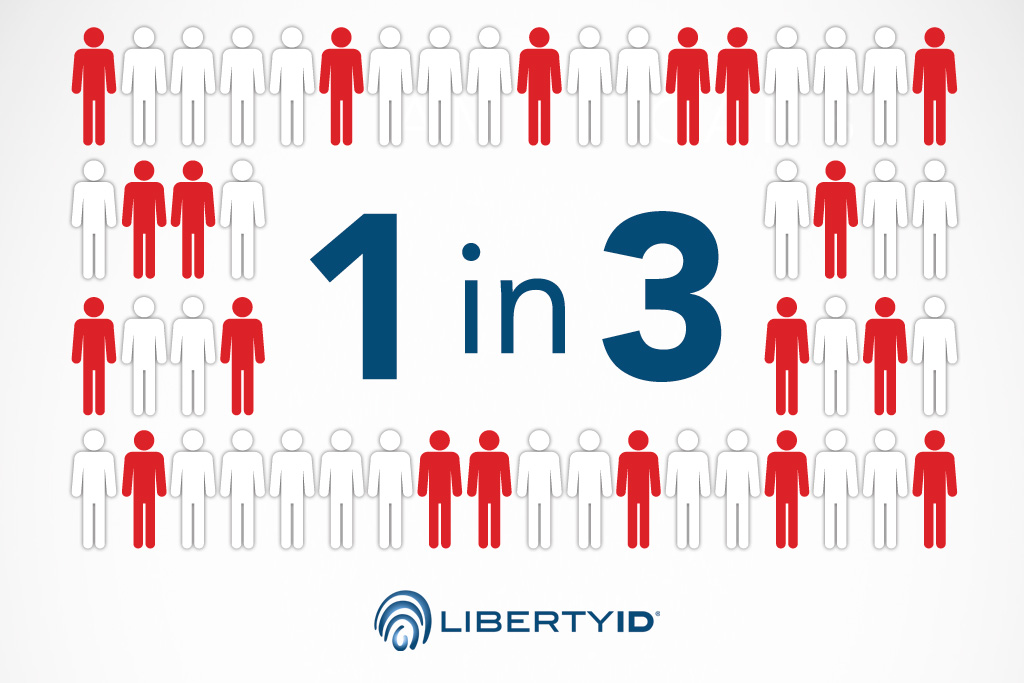

The relationship between data breaches and identity theft grows stronger each year, according to a survey by the National Consumers League (NCL) and Javelin Strategy & Research. In 2010, one in nine victims of a data breach also had their identities stolen. As of 2013, that risk has increased to one in three.

The Good News: You Can Take Steps To Lower Your Risk Of Identity Theft

Following the guidelines below can help make you a less attractive target for thieves, or help you recover quickly if a breach does occur.

- Monitor our accounts closely

If you see anything suspicious on your banking or credit card statement, get in touch with your financial institution immediately. The more quickly you report suspicious charges, the better chance you’ll have of making sure the fraud stops there. - Never share personal information with unknown parties

Don’t share sensitive information with anyone unfamiliar to you—especially if you weren’t the one to initiate contact. If the person claims to represent a company you trust, ask for their contact information, as well as clarification about the reason for the call. Then end the call, and contact a Customer Service representative directly to resolve the matter. - Always hide sensitive information and documents in public

We take out our credit cards, driver’s licenses, and passports often in the course of our normal shopping, travel, and entertainment routines. Unfortunately, giving someone even a moment to glimpse an ID number can put you at risk. Make it as difficult as possible for an onlooker to capture your data by covering up the identifying information. - Be extra careful with your Social Security card

In general, it’s best to keep your Social Security card locked up at home or in a safe deposit box.

You may need your Social Security number (SSN) to open a bank account or for an employer’s records.If a company asks for your Social Security number during the employment application process, find out whether you can provide an alternate form of identification. They may not actually need the number unless you’re an official employee. - Contact fraud departments if your information is compromised

If you’re afraid your data has been exposed, take action right away so the breach doesn’t turn into identity fraud. Contact the fraud department of the three main credit agencies: Equifax, Experian, and Trans Union, and have them issue a fraud alert for your accounts. Doing so will help prevent fraudulent accounts from being opened in your name.Make sure to request credit reports from each of the agencies and review them carefully for suspicious activity. As a LibertyID subscriber, we can help you with this process.